direct vs indirect cash flow gaap

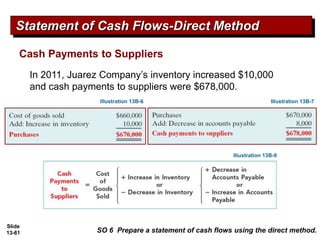

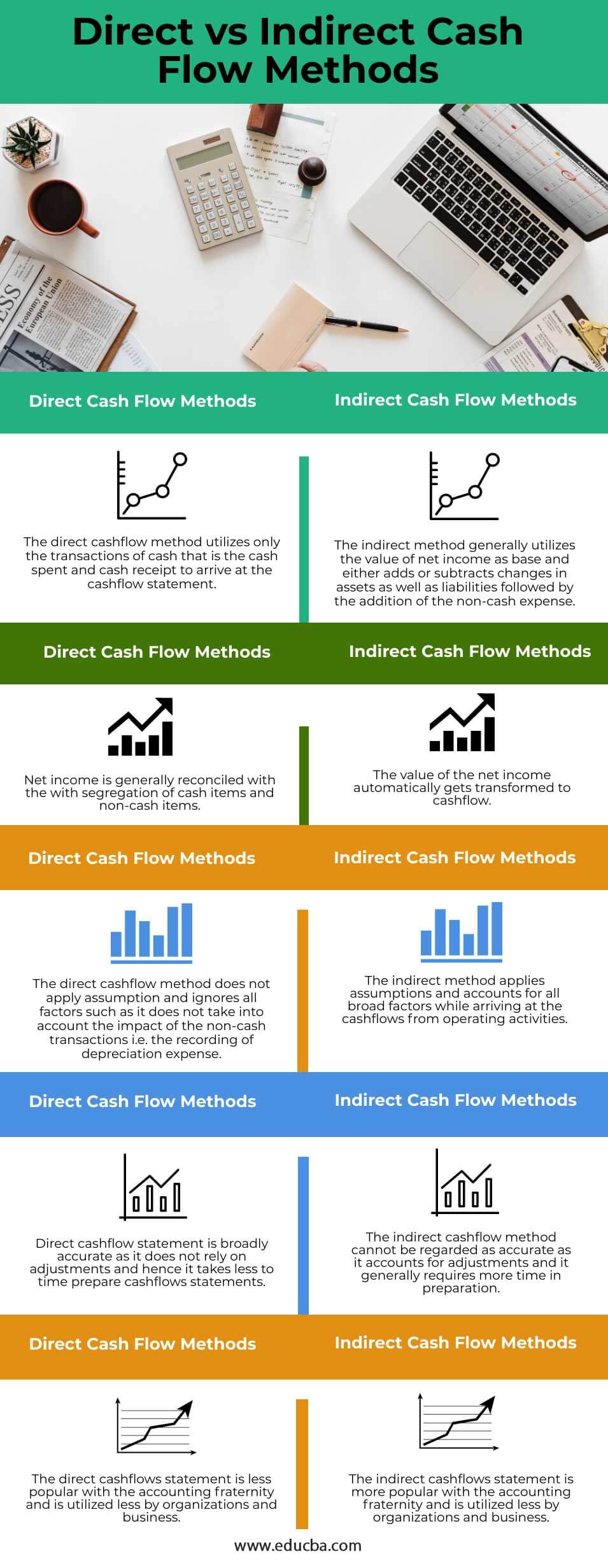

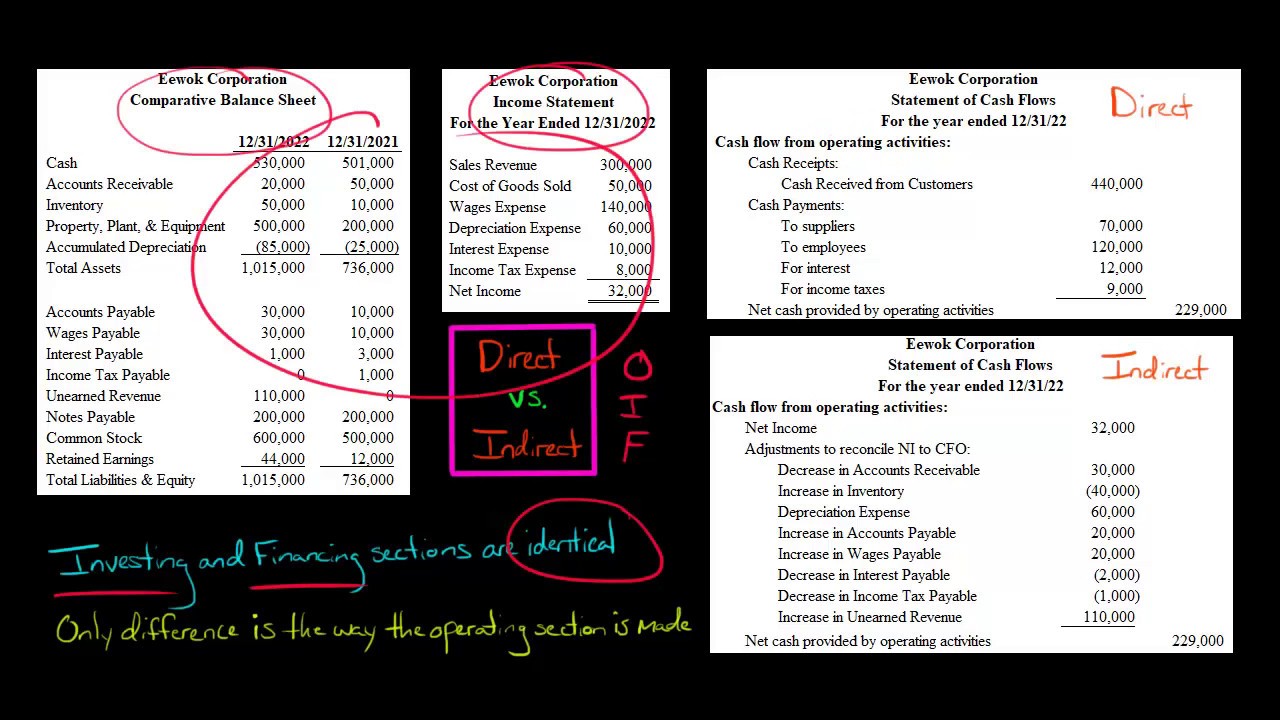

For example if a retailer sells an item on credit the indirect method will consider this as income and reflect this in the figures whereas the direct method wont include it until the bill has been paid. Comparing the Direct and Indirect Cash Flow Methods.

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

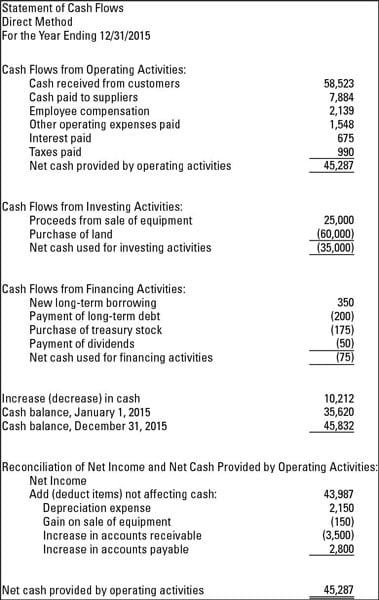

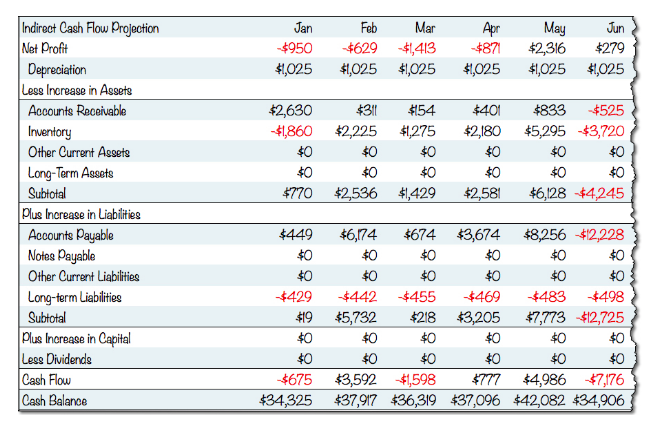

In contrast under the indirect method cash flow from operating activities is calculated by first taking the net income from a companys income statement.

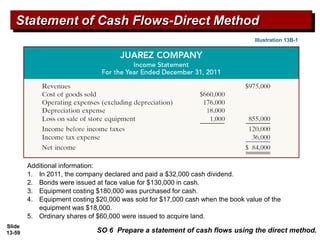

. The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows. The direct method lists the cash receipts and cash payments made during the accounting period. GAAP requires a reconciliation of net cash flow from.

The indirect method begins with your net income. This is why both IFRS and US GAAP recommend the direct method. Either the direct or indirect method may be used for reporting cash flow from operating activities.

Under US GAAP defined benefit pension plans that present financial information under ASC 960 3. Many US corporations use the indirect method so this method should be known. Sample Direct Reporting.

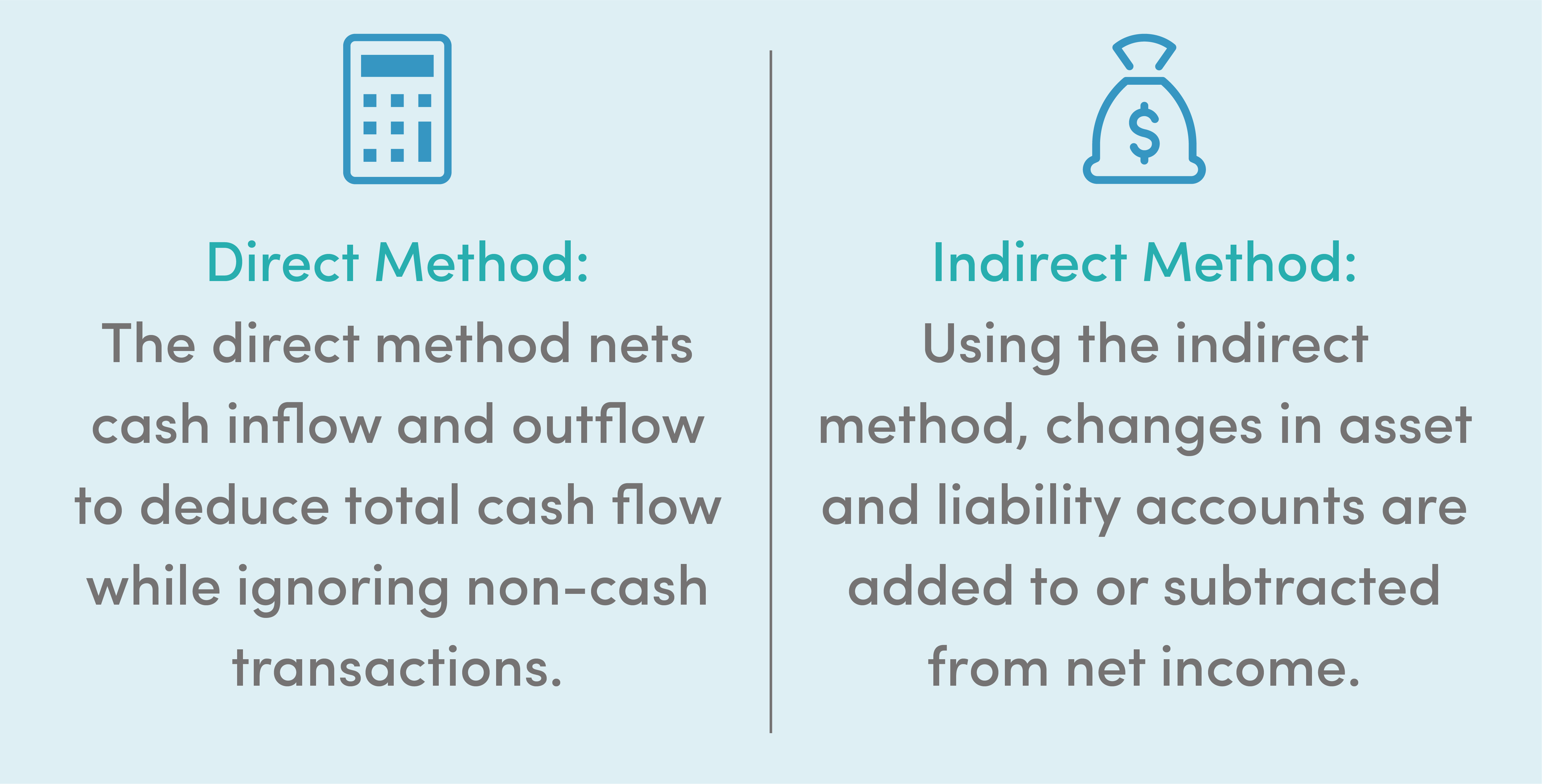

Up to 5 cash back IAS 7 and Section 230-10-45 FASB Statement No. The main difference between the direct and indirect cash flow statement is that in direct method the operating activities generally report cash payments and cash receipts happening across the business whereas for the indirect method of cash flow statement asset changes and liabilities changes are adjusted to the net income to derive cash flow from the. Although the presentation of operating cash flows differs between the two methods both methods result in the same amount of net cash flows from operations.

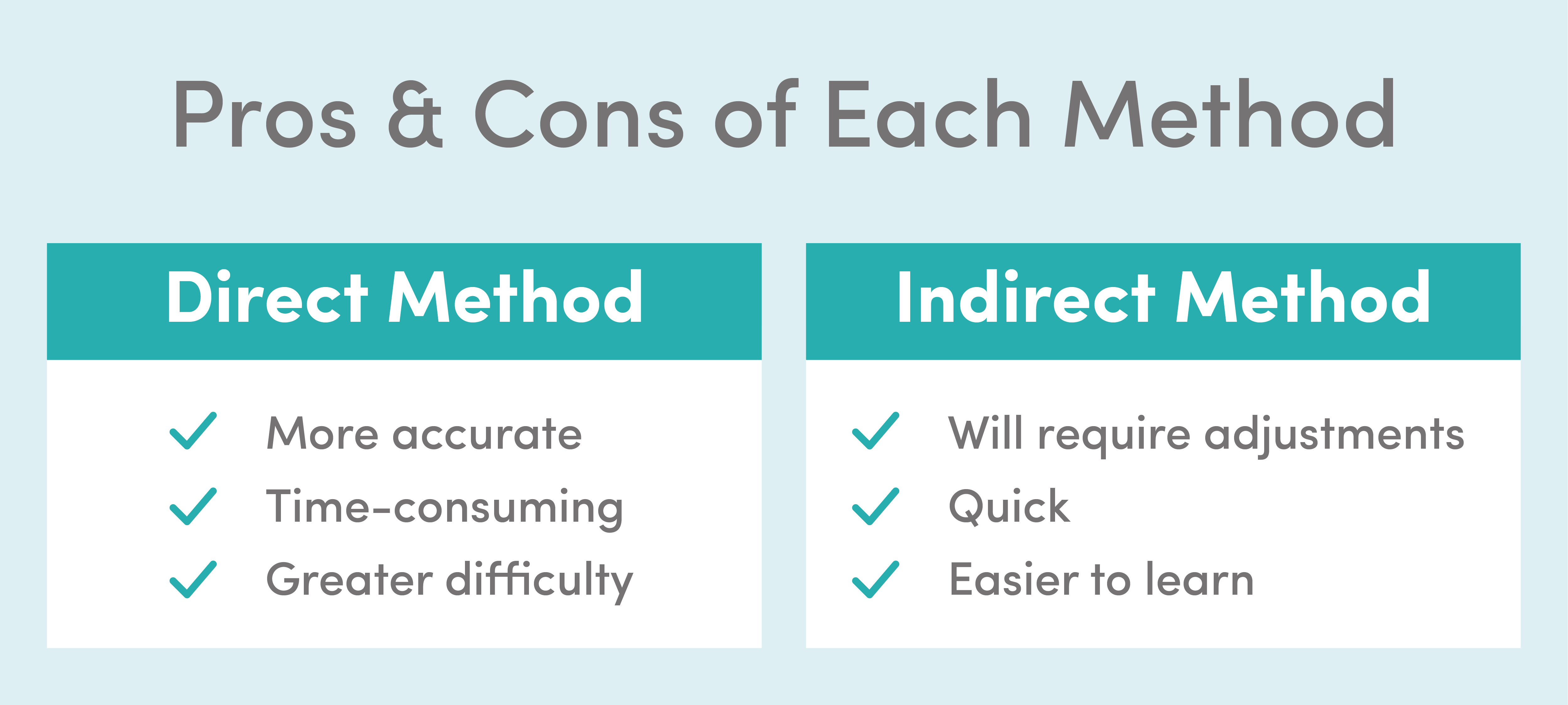

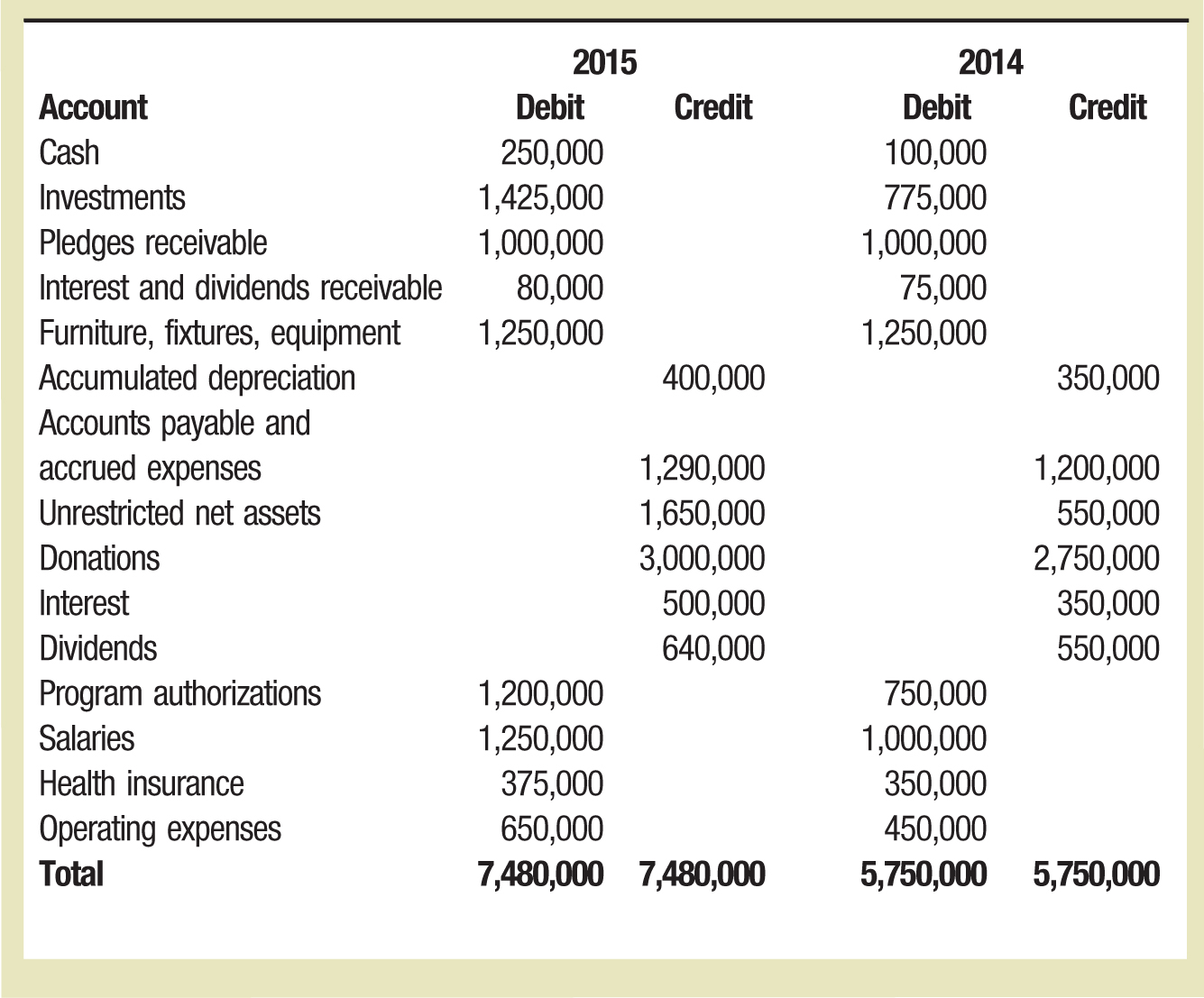

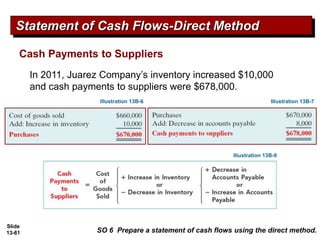

The direct method only. The first four Exhibits show the trial balance used to develop the financial statements statement of activities Exhibit 2. The direct method is one way for a company to prepare its cash flow.

108 In addition unlike IFRSs US. Statement of cash flows always required under IFRS Standards. US GAAP shows bank overdrafts as financing activities.

US GAAP allows businesses to choose the direct or indirect method but even when using the direct method a reconciliation of cash flow from operating activities to net profit net income is required. The key difference between direct and indirect cash flow method is that direct cash flow method lists all the major operating cash receipts and payments for the accounting year by source whereas indirect cash flow method adjusts net income for the changes in balance sheet accounts to calculate the cash flow from operating activities. Indirect method is the most widely used method for the calculation of net cash flow from operating activities.

Direct method vs indirect method The direct method provides information about specific sources and uses of cash but the indirect method shows only the net result. And statement of cash flows Exhibit 4 for a hypothetical NFP entity using the indirect methodThe NFP organizations governing board now desires a cash flow statement that better. Under IFRS Standards there are no scope exceptions and all companies must present a statement of cash flows in a complete set of financial statements.

Indirect Method The indirect method is the more popular method of preparing a cash flow statement. However most companies charts of accounts are not structured in a way to accommodate this easily. Two categories exist for direct cash flow cash coming from customers and cash disbursements.

US GAAP Requirements Interest received must be classified as an operating activity. The direct method lists the cash receipts and cash payments made during the accounting period. The direct method is a way to present and prepare the statement of cash flows by listing the operation cash receipts and payments in the cash from operations section.

It is because most businesses around the world follow international accounting standards and the GAAP Generally Accepted Accounting Principles. Indirect cash flow methods. The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments.

Revenue cash inflows and expense cash outflows are adjusted by multiplying the cash flow by. Under this method net cash provided or used by operating activities is determined by adding back or deducting from net income those items that do not effect on cash. The following are the common types of adjustments that are made to.

Either the direct or indirect Net income must be reconciled to net cash flows from operating activities if the indirect method is used. While both are ways of calculating your net cash flow from operating activities the main distinction is the starting point and types of calculations each uses. Interest paid must be classified as an operating activity.

Exceptions exist under US GAAP. The indirect method on the other hand focuses on net income and may include cash that is not yet in the business. Statement of position Exhibit 3.

The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement. While ASC 230-10-45-25 encourages the use of the direct method the large majority of reporting entities elect to use the indirect method. 95 permit the direct and the indirect method of reporting cash flows from operating activities.

The indirect method uses net income as the base and converts the income into the cash flow through the use of adjustments. The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions. The Financial Accounting Standards Board FAS recommends the direct cash flow method because it is a more transparent cash flow view.

Indirect cash flow method is the type of transactions used to produce a cash flow statement. Under the indirect method the cash flow statement begins with net income on an accrual basis and subsequently adds and subtracts non-cash items to reconcile to actual cash flows from operations. One of the key differences between direct cash flow vs.

Here are the key differences between direct vs. There are no presentation. However of the two the direct method is generally encouraged.

Statement of cash flows resulted from the efforts and ideas of various RSM US LLP professionals including members of the National Professional Standards Group as well as. Alternatively the direct method begins with the cash amounts received and paid out by your business. GAAP also calls the indirect method the reconciliation method.

106 Both encourage the use of the direct method.

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

Pengantar Akuntansi 2 Ch13 Statement Of Cash Flow

Cost Accounting Ebook Rental Cost Accounting Accounting Education Accounting

The Essential Guide To Direct And Indirect Cash Flow Cash Flow Statement Cash Flow Accounting Basics

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

What Is The Difference Between The Direct And Indirect Cash Flow Statement Methods Universal Cpa Review

What Is The Difference Between Indirect And Direct Cash Flow Quora

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

The Direct And The Indirect Method For The Statement Of Cash Flows Online Accounting

Direct Vs Indirect Method Statement Of Cash Flows Youtube

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Excel Spreadsheets Templates Spreadsheet Template

Difference Between Direct And Indirect Cash Flow Compare The Difference Between Similar Terms

Pengantar Akuntansi 2 Ch13 Statement Of Cash Flow