what is a tax provision account

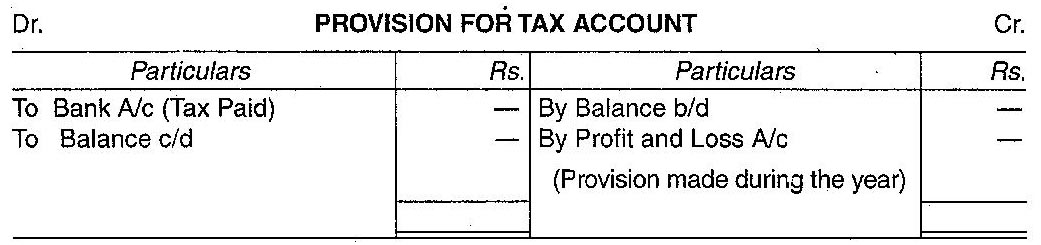

The provision in accounting means that amount which is charged against Profit or loss account Income statement for some uncertain. Tax provisions are an amount set aside specifically to pay a companys income taxesIn order to calculate the tax amount owing a business needs to adjust its gross income.

Cash Flow Statement Treatment Of Provision For Tax Youtube

The amount of the said.

. This includes federal state local and foreign income taxes. As it is an estimate of tax liability therefore it is recorded as a provision and not a liability. Add or subtract the net change in.

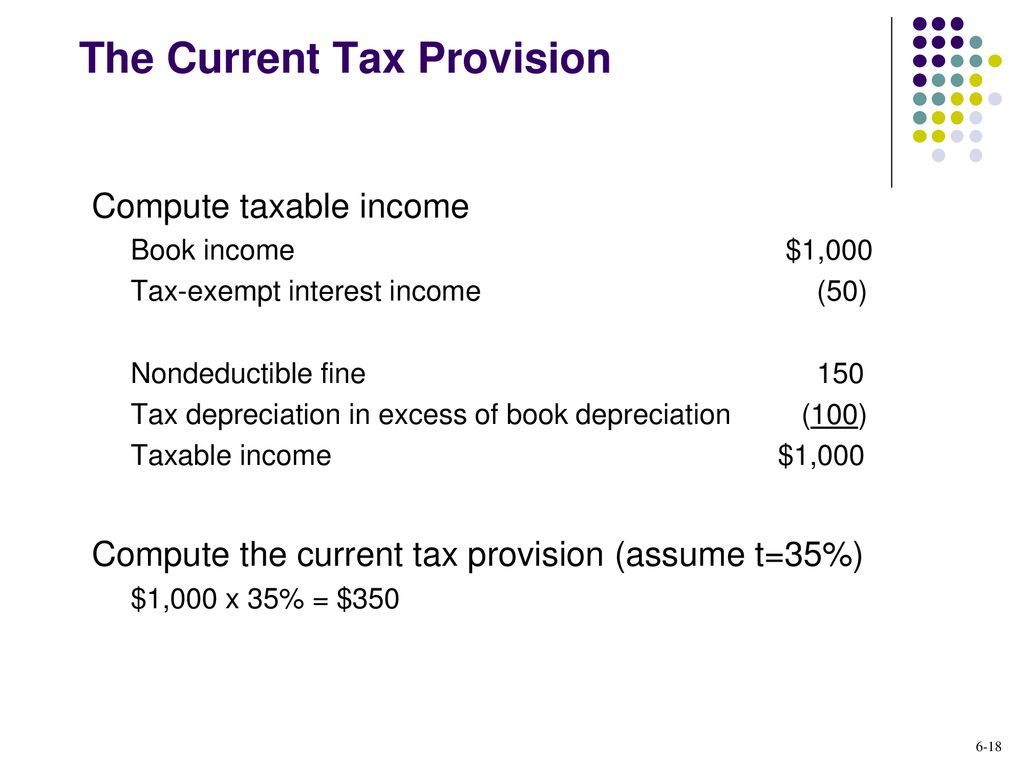

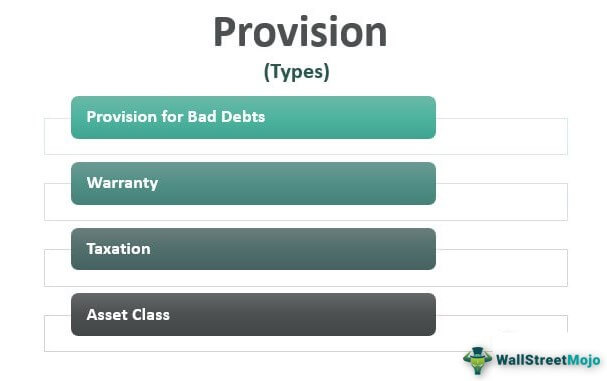

What is Provision in accounting. Tax Provision Estimated Net Taxable Income x Estimated Tax Rates Buffer Amount. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year.

While this looks like a simple formula the actual process of estimating your taxable. VAT Provision- tax becomes due or claimable only when you receive or make the payment. More precisely these are provisions for taxes that arose within a financial year for economic.

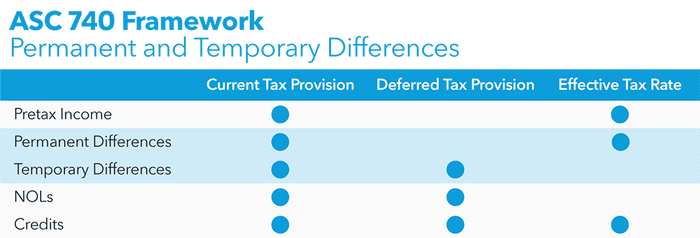

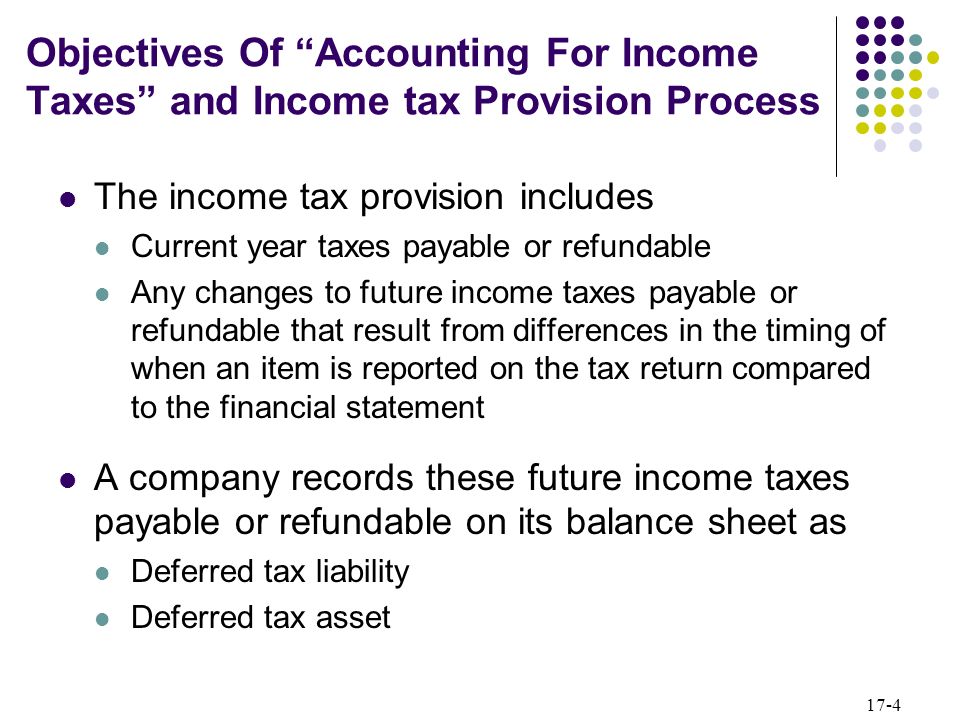

A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. Similar to accounting provisions tax provisions are an. A tax provision is set aside to pay your companys income taxes which are calculated by adjusting gross income by claimed tax.

When you process the sale or purchase the system needs a holding account to accumulate the. A tax provision is the income tax corporate entities will incur based upon the companys net income for the year. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year.

This is usually estimated by applying a fixed percentage. The amount of this provision is. The amount of this provision is.

A tax provision is the income tax corporate entities will incur based upon the companys net income for the year. A deferred income tax liability results from a difference in. What is a tax provision.

The so-called tax provisions are a special form of ordinary provisions. The amount of this provision is. An income tax provision represents the reporting periods total income tax expense.

What Is A Tax Provision Account. The provision of income tax is defined as the estimated amount that a business or an individual taxpayer expects to pay in terms of income taxes in the given year. A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year.

The actual payment of tax can be.

Adjustment In Final Accounts Tax Adjustment

Cbse Class 12 Concept Of Provision Of Tax In Hindi Offered By Unacademy

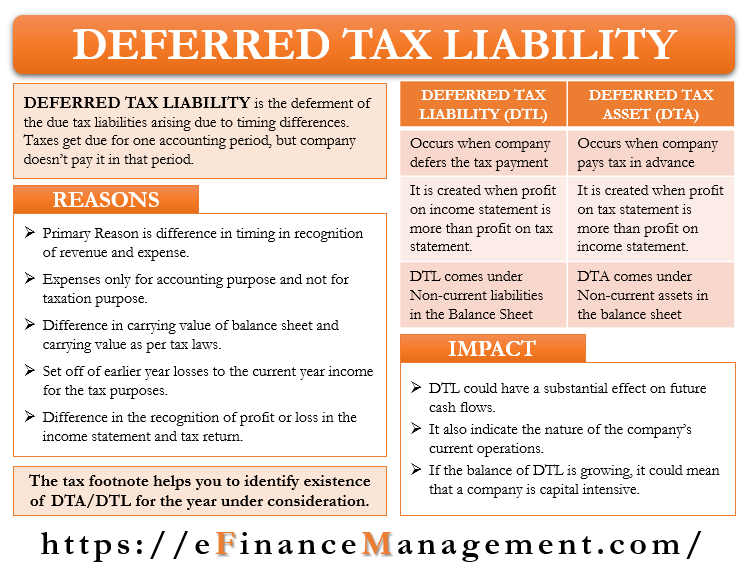

Deferred Tax Liabilities Meaning Example Causes And More

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

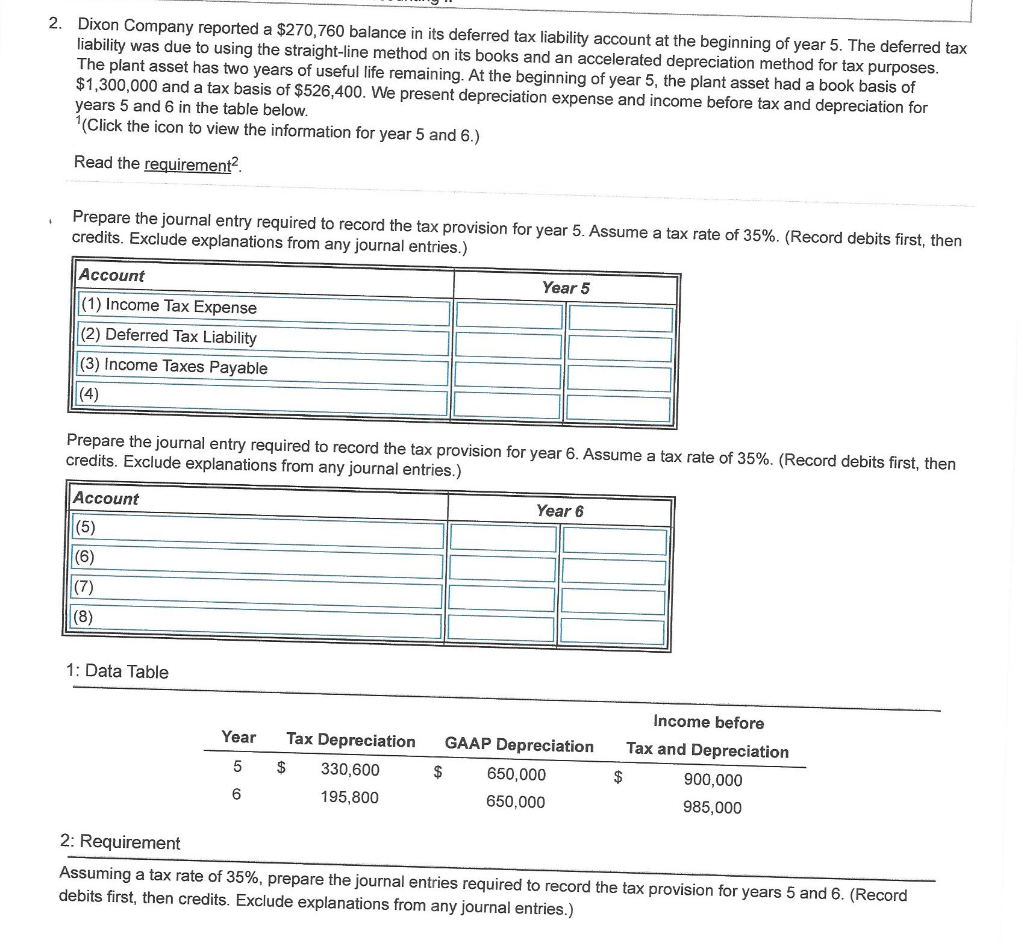

Solved 2 Dixon Company Reported A 270 760 Balance In Its Chegg Com

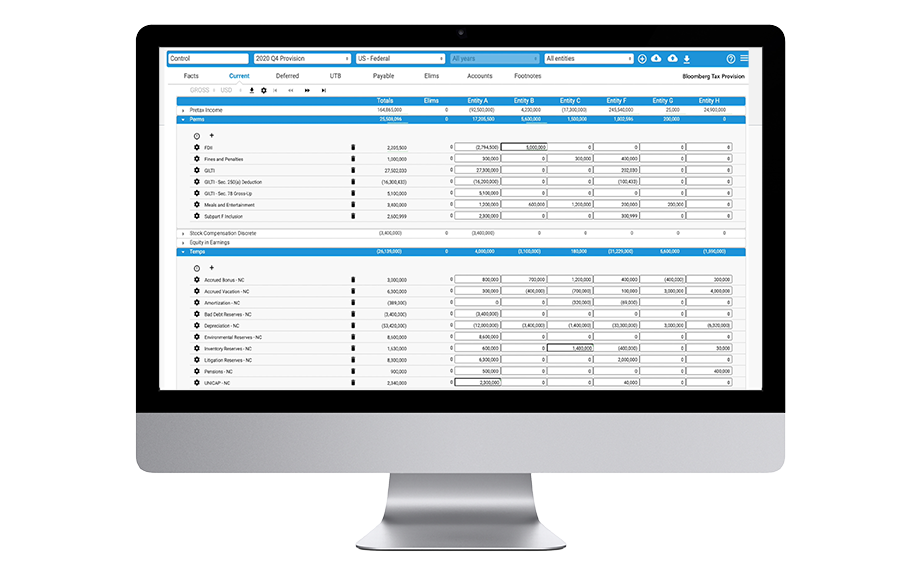

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Deferred Income Tax Definition Example How To Calculate

Cbse Class 12 Provision For Tax Account In Hindi Offered By Unacademy

Accounting For Income Taxes Ppt Download

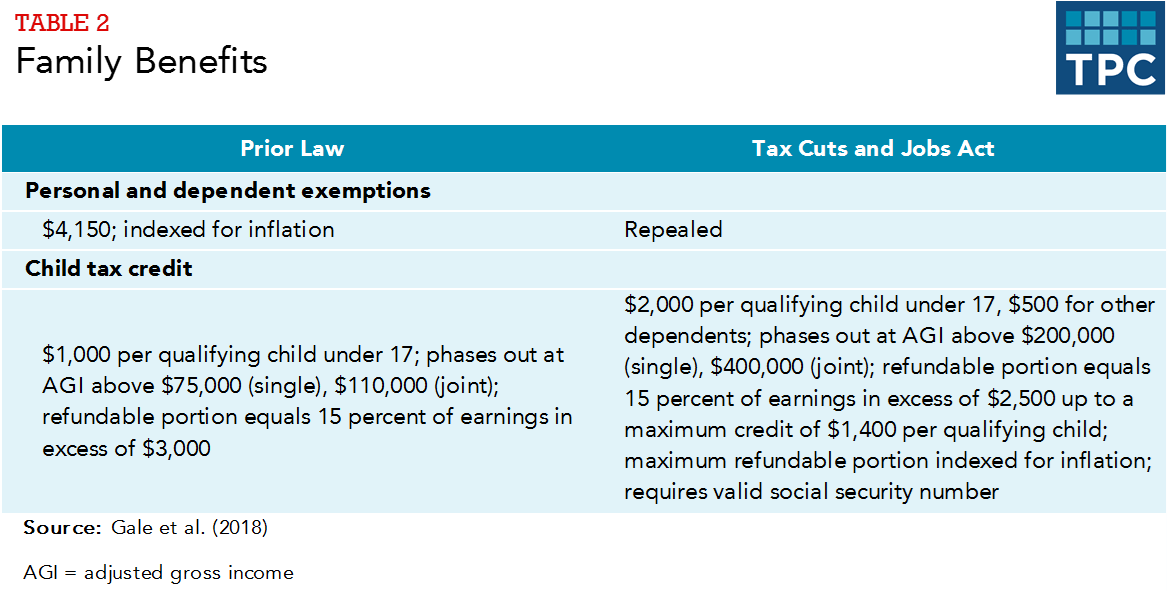

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Fas 109 Accounting For Income Taxes Ppt Download

Provision In Accounting Meaning Examples How To Create

What Is Tax Provisioning How To Calculate It Mosaic

Accounting For Income Taxes Ppt Download

How Would You Treat The Following Items In The Cash Flow Statement I Proposed Dividend Ii Provision For Taxation Iii Profit Or Loss On Sale Of Fixed Assets Owlgen